The situation in the industry is challenging, but there is significant potential due to the mineral agreement with the US and EU programs

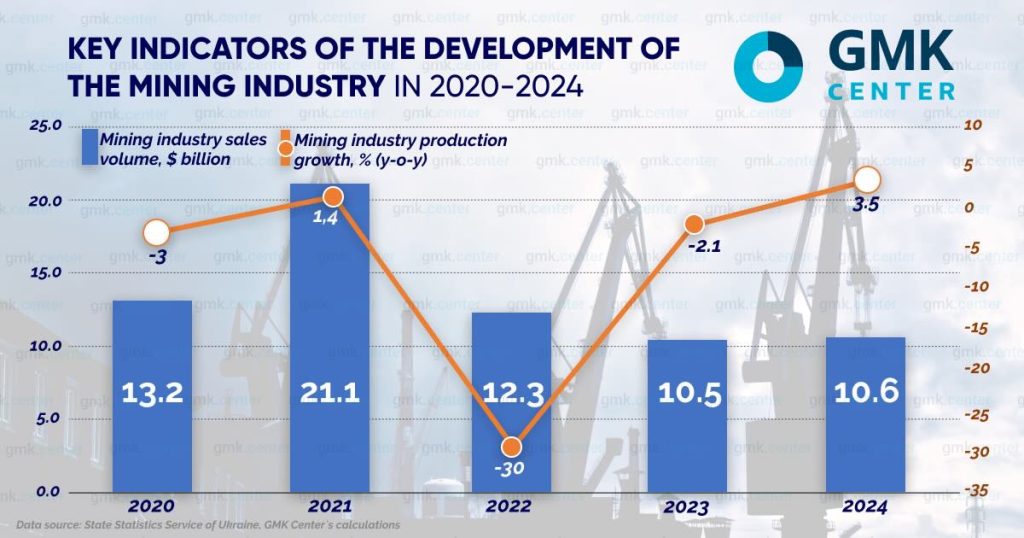

Ukraine’s mining industry suffered a devastating blow in 2022, with production falling by 30%. Despite a partial recovery in 2023-2024, the industry continues to face critical challenges: loss of production capacity, rising electricity costs, higher logistics costs, and a shortage of qualified personnel. At the same time, the industry retains significant potential: Ukraine has deposits of 24 out of 34 critical EU minerals, including lithium, graphite, and titanium. The strategic agreement with the US to create an investment fund and the prospects for participation in European programs open up new opportunities.*

Consequences of the war for the industry

The mining industry is one of the key sectors of the Ukrainian economy, accounting for 4-6% of the country’s GDP. Like the rest of the country’s economy, the industry suffered a devastating blow in 2022 as a result of Russia’s full-scale invasion. Losses of industrial assets, disruption of logistics, and capital shortages led to a deep recession. In the first year of the war, production in the extractive industry fell by 30% yoy.

In 2023-2024, a partial recovery began, but 2025 shows new challenges – a drop in production, export restrictions, and the loss of strategic resources. Investments are growing, but the political and military situation poses significant risks. Nevertheless, the industry remains one of the key sectors of the Ukrainian economy, especially in conjunction with steel industry.

The structural problems and challenges of Ukraine’s mining industry include:

- Loss of production capacity. The stoppage and destruction of enterprises in Donetsk, Luhansk, and Zaporizhzhia oblasts created long-term production gaps. This is especially true for coking coal.

- Rising electricity costs. Ukrainian producers buy energy at a higher price than their European competitors. In 2025, electricity prices on the day-ahead market will be 52% higher than in Germany.

- Rising logistics costs. Transportation costs in 2024-2025 were 2-3 times higher than pre-war levels. This had a critical impact on the competitiveness of iron ore and steel products.

- Financial instability. Non-refund of VAT (Ferrexpo’s example is $25 million) creates additional risks for exporters.

Shortage of personnel. Due to mobilization and migration, the country has lost a significant number of qualified personnel in various segments of the extractive industry.

Let us consider the situation in the key segments of the mining sector.

Iron ore

In 2024, Ukraine increased iron ore exports by 90% y/y – to 33.7 million tons. Export volumes increased due to the opening of the sea corridor in August 2023. However, this year there has been a decline – in January-September 2025, iron ore exports decreased by 4.4% yoy to 24.1 million tons. The main reason for this is the decline in ore prices on the global market in March-July.

The current trends in iron ore exports and pricing show that the Ukrainian mining industry is heavily influenced by two main factors – external market fluctuations and internal financial and management problems. Weakening demand from major importers, volatility in mineral prices, increased logistics costs and tax imbalances are creating serious obstacles for companies that have historically generated a significant share of foreign currency revenues.

The sector is particularly affected by the issue of late VAT refunds for exported products. In particular, Ferrexpo has been forced to shut down two pelletizing lines since May this year due to the government’s VAT refund arrears of more than $25 million.

Ukraine has a huge potential to provide raw materials for the «green transition» of the European steel industry. Our country has significant opportunities to supply the European Union with high Fe pellets, which will enable accelerated decarbonization of the EU’s steel capacity. In addition, Ukraine could become the main supplier of DRI to the EU. GMK Center estimates that potential commercial supplies of DRI raw materials from Ukraine in the medium term could amount to 20-25 million tons.

Metinvest may become a key player in this process, as its strategy for a «green transition» remains unchanged despite the war. The key prerequisites for investing in the group’s assets are large reserves of magnetite ore, which ensure sustainable DRI/HBI production, long-term expertise in iron ore production, green transformation, strategic positioning, and proximity to Europe.

The company is currently focused on the following current and future projects:

- Modernization of enrichment facilities at Northern Mining and Processing Plant (Northern Mining). Focus: production of high-quality iron ore concentrate for DR pellets.

- Modernization of the pelletizing plant at Northern Mining. Focus: improving pellet quality and equipment productivity.

- Construction of DR pelletizing facilities. Focus: expanding capacity to meet the growing demand for high-quality iron ore.

- Construction of DRI/HBI production facilities. Focus: construction of up to 3 new units with a total capacity of 7.5 million tons per year. At the initial stage, the units will operate on natural gas, and in the future they will switch to hydrogen.

For its part, Ferrexpo announced plans to build a DRI module that will allow it to supply HBI to the global market. GMK Center estimates that the total capital expenditures required to implement the already announced green steel projects in Ukraine are about $11 billion, or about $1,500 per ton of steel.

Coking coal

Ukraine has lost its largest domestic source of coking coal, the Pokrovske mine. The company was closed at the end of 2024 due to the proximity of the active war zone, power outages and the risk of constant shelling. It was the impairment provision for Metinvest Pokrovskugol ($1.3 billion) that contributed to Metinvest’s net loss last year of $1.15 billion.

According to GMK Center, the loss of mine management resulted in the need to import 2.5 million tons of coking coal, which added $20-30 per ton of steel to the cost of production. In particular, Metinvest imports coking coal from its US-based United Coal and other sources. It also uses other types of Ukrainian coal in the coking charge.

Oil and gas

Ukraine’s extractive industry is based on oil and gas production. The oil and gas industry has suffered greatly as a result of the war: Ukrainian oil refining has virtually ceased to exist, almost 40% of gas production facilities were destroyed or damaged by shelling earlier this year, and gas transportation infrastructure is under constant attack.

However, the dynamics of oil and condensate production in Ukraine did not show a decline even in the face of war. Thus, in 2022, this figure increased by 10% to 1.82 million tons compared to the pre-war year 2021, having increased to 2 million tons last year.

In 2019-2022, gas production decreased from 20.7 to 18.5 bcm, but in 2024 it recovered to 19.1 bcm (+2.3% y/y). Last year’s production leaders were Naftogaz’s companies Ukrgazvydobuvannya (14.5 bcm) and Ukrnafta (1.2 bcm), which accounted for 82% of the country’s total gas production.

However, private companies are performing worse. While in 2021 they produced 5 billion cubic meters of gas, in 2024 this figure dropped to 3.4 billion cubic meters due to the difficult investment climate.

Due to the destruction or damage to some gas production facilities this year, Ukraine’s domestic gas production has decreased, leading to an increase in imports. As a result, gas prices for industrial consumers have risen sharply, which negatively affects the cost of production and competitiveness of Ukrainian producers.

Attracting investment in the industry

Ukraine’s investment attractiveness is at critically low levels due to the war and related risks. The corresponding index calculated by the European Business Association rose to 2.49 points out of 5 in 2024, compared to 2.44 points in 2023. This indicates a slight improvement in the investment climate, although the vast majority (79%) of surveyed CEOs still consider it unfavorable.

However, it is already necessary to create conditions for potential investors as part of the country’s post-war recovery. As a result of the war in Ukraine, the number of companies engaged in mining has decreased by 11% to 1.55 thousand. This may stimulate the inflow of risky investors willing to invest with a higher share of risk in extractive assets.

For investments to come to Ukraine, simple principles need to be followed: clear rules, clarity and transparency, predictability of government policy, and a dialogue with business. From the perspective of business security, we need an end to hostilities and firm security guarantees. For its part, the state must create the necessary conditions for the effective functioning of the extractive industry, which include:

- predictable and adequate tariff policy of state monopolies;

- affordable energy prices;

- access to long-term loans;

- liberalization of currency regulation;

- effective system of insurance against war risks;

- favorable tax policy.

Although all of these points are important, the first two are the most pressing at the moment. In particular, over the past year, tariffs of energy monopolies and prices for electricity and gas for industrial consumers have increased significantly, which has a very negative impact on the competitiveness of large Ukrainian exporters. It was the increase in the cost of tariffs of state monopolies for electricity and railroad transportation that led to the shutdown of Ingulets Mining in July 2024.

Tax, customs, and other benefits are also important for attracting investment, but in this case, they need to be balanced with the interests and capabilities of the state. According to Sergiy Skorbun, Head of External Projects at the Office of the CEO of Metinvest Group, it is important to at least defend the interests of our producers in foreign markets and expand their access to markets in other countries through trade diplomacy.

According to Roman Ivaniuk, managing partner of BrightOne Capital, many global investors are already saying that they are potentially interested in Ukraine, but they will come only 12 months after the end of the hostilities, when they are sure that the security situation is stable. The first to come will be extractive companies, strategic investors with political commitments, and financial investors. The second tier will be made up of investment funds and others.

A good basis for increasing investment in the extractive sector may be the strategic agreement on the establishment of the Investment Fund for Recovery and Partnership in Critical Minerals, signed by Ukraine and the United States on April 30 this year. The fund will be invested exclusively in Ukraine – in mining, infrastructure, and processing projects. Moreover, the fund’s profits will be reinvested in Ukraine for the first 10 years. At the same time, Ukraine retains full control over subsoil and resources.

In September, the United States made the first contribution to the investment fund in the amount of $75 million. Now Ukraine has to make its share, forming the fund’s start-up capital of $150 million. The first list of potential projects is being formed. The first practical step could be the development of the large Dobra lithium deposit in Kirovohrad region.

For his part, Oleksandr Vodoviz, Head of the Office of the CEO of Metinvest Group, notes that without attracting foreign investment, it is impossible to develop projects in the mining industry that are capital-intensive and have a very long payback period. However, at the moment, Ukrainian businesses are mostly investing in the development and maintenance of their enterprises on their own.

Opportunities for the mining industry

The post-war reconstruction of the country will create an explosive demand for steel, cement, crushed stone, and glass. This will open up new opportunities for the mining industry, namely for the extraction of iron ore and a wide range of construction minerals, steel sector, as well as for producers of building materials, cement, etc.

The development of green steel industry, construction of renewable energy facilities, and launch of battery materials production could provide an additional impetus to the industry.

Ukraine’s participation in EU programs (Critical Raw Materials Act) as part of European integration will help to consolidate the country’s role in the supply of lithium, graphite, and titanium. Ukraine can become an important supplier for the EU’s energy transition, as it has deposits of 24 out of 34 critical minerals identified by the EU. In particular, Ukraine has the following important minerals:

- lithium – about 500 thousand tons (one third of the European total);

- graphite – 19 million tons (one of the largest in the world);

- titanium – about 7% of global production.

The Ukrainian mining industry has significant potential for development, particularly given global trends in artificial intelligence, progress in the aerospace and energy sectors. Ukraine’s mineral resources include 8.8 thousand deposits of industrial importance of 117 types of minerals (out of the 120 most common) with an estimated value of $14.8 trillion. The industry also has exceptional prospects of becoming an important supplier of materials for Europe’s green economy. The basis for attracting investment is the formation of clear, stable legislative norms and consideration of international investment environment.

The development of the mining industry creates a multiplier effect for the entire Ukrainian economy. Metinvest estimates that one job at a mining and processing plant creates four more jobs at railways, ports, energy and many other industries. That’s why large export companies that bring foreign currency earnings to the country need systematic government support.

What is happening in the mining industry in the fourth year of the war