Mining power provider CrossBoundary has secured a $40-million funding from Impression Fund Denmark to broaden its portfolio of unpolluted power initiatives throughout Africa.

The funding helps CrossBoundary deployment of photo voltaic PV and battery storage throughout Africa.

Impression Fund Denmark targets local weather motion, poverty alleviation and financial development by power options that drive sustainable growth and improved high quality of life.

MD and inexperienced power co-head Thomas Hougaard described the funding in a media launch to Mining Weekly as one which contributes in direction of bettering the standard of life for communities.

Important development alternatives on the continent are seen by Hougaard, who views revolutionary power options as unlocking financial potential and driving inclusive progress.

The photo voltaic and battery power storage options envisaged carry extra energy capability to sectors that require secure electrical energy, whereas versatile energy buy agreements (PPAs) allow enterprises to entry power with out the necessity to interact in any of their very own capital expenditure (capex).

CrossBoundary’s zero-capex mannequin is highlighted by CEO Pieter Joubert as one which lowers the barrier to entry for African companies in search of secure, clear and cost-effective energy.

“As soon as firms’ steadiness sheets are freed as much as put money into their core value-generating actions fairly than energy provision, they will attain and exceed their targets, unlocking additional financial worth within the areas during which they function,” Joubert emphasised.

After signing a business and industrial PPA with Kamoa Copper within the Democratic Republic of Congo, CrossBoundary is establishing a photo voltaic and battery power storage system baseload plant in Africa that’s poised to uplift Kamoa’s output and improve its regional financial influence.

CrossBoundary affiliate principal Tom Roberts spoke of the funding from Impression Fund Denmark as being essential for the supply of CrossBoundary’s service providing to shoppers corresponding to Kamoa.

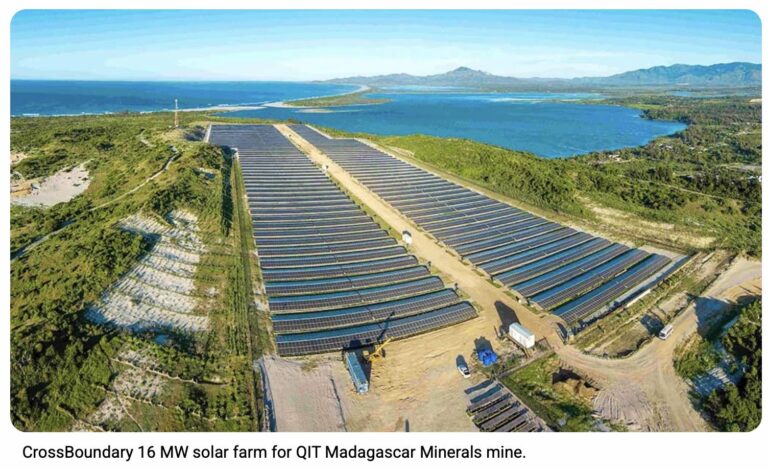

CrossBoundary can be heading in direction of the business operation date section of the wind undertaking to assist energy QIT Madagascar Minerals, a three way partnership between Rio Tinto (80%) and the federal government of Madagascar (20%), close to Fort Dauphin amid the 2 substantial photo voltaic phases additionally developed for the ilmenite, zircon and rutile minerals sands mine, within the Anosy area of south-eastern Madagascar.

Earlier this 12 months, Norfund doubled its funding in CrossBoundary to $80-million, following a $140-million senior debt shut from Customary Financial institution on the finish of 2024, as the primary tranche of a $300-million senior debt mandate.

CrossBoundary additionally lately secured a $495-million assure framework from the World Financial institution’s MIGA, which is able to shield its property from switch restriction and forex inconvertibility.

Whereas CrossBoundary develops, owns, and operates distributed renewable power options for companies, providing power by PPAs and lease agreements, Impression Fund Denmark supplies creating area danger capital.